people's pension higher rate tax relief

London 31 January 2020. 1 up to the amount of any income you have paid 21 tax on.

Q A Pension Automatic Enrolment International Reward

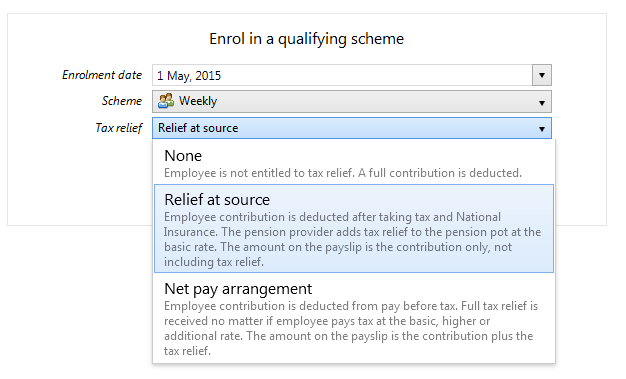

Relief at source means your contributions are taken from your pay after your wages are.

. Solve All Your IRS Tax Problems. - As Heard on CNN. Higher rate tax relief works by increasing the thresholds upon which an investor pays basic and higher rate tax by the amount of gross personal pension contribution paid.

On the day of the Self-Assessment tax return deadline analysis by PensionBee finds that 80 of higher rate taxpayers are likely to be. The rules are different for those paying the 40 higher-rate income tax and also the 50 highest tax rate. The base rate tax relief of 20 is immediately applied to the full amount.

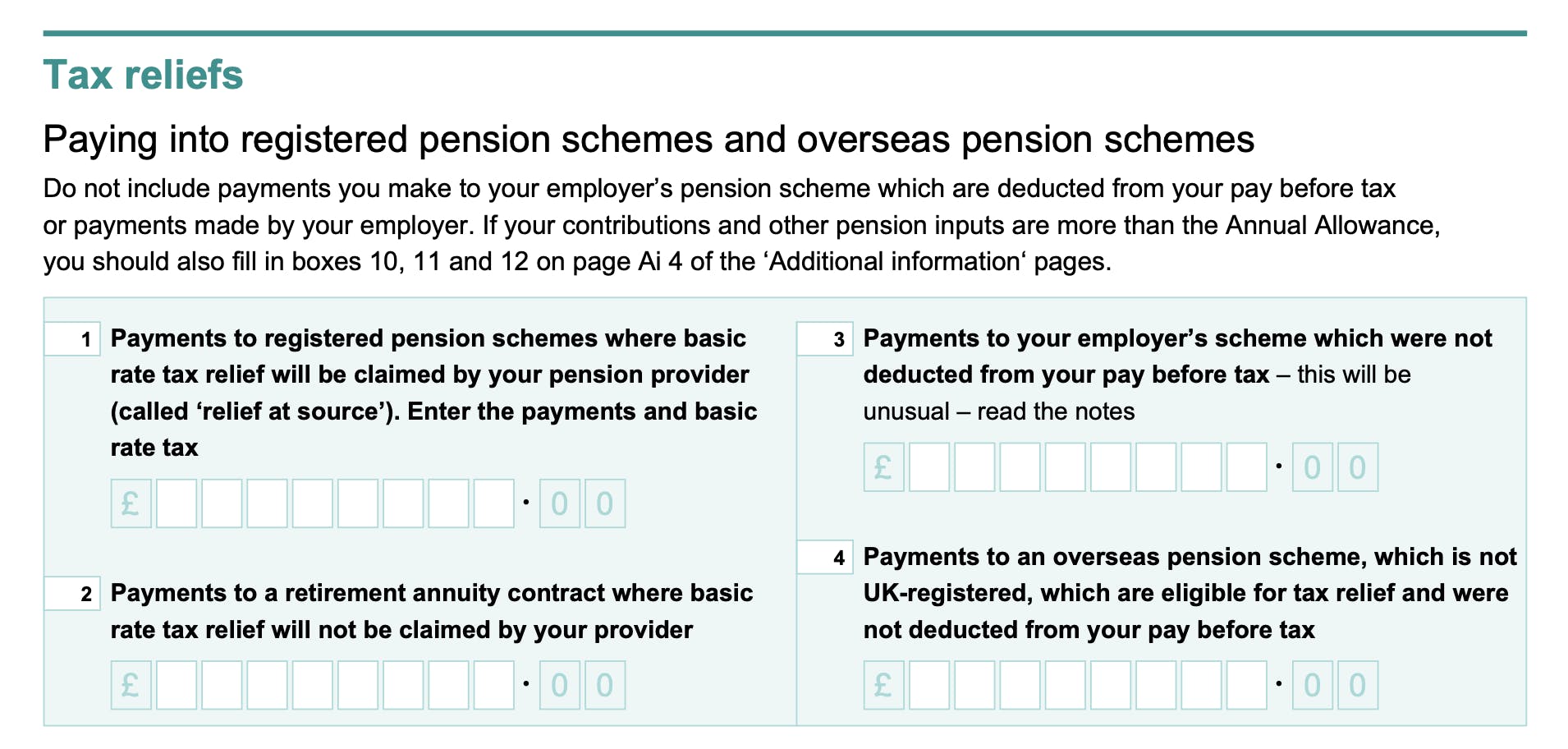

You can claim additional tax relief on your Self Assessment tax return for money you put into a private pension of. Ad Honest Fast Help - A BBB Rated. How does higher rate pension tax relief work.

100 Money Back Guarantee. If you pay tax at 20 no further relief is due to you. ConsumerVoice Provides Best Most Updated Reviews to Help You Make an Informed Decision.

Ad BBB A Rating. A full blown switch to relief at source arrangements would mean higher earners have to reclaim pensions tax relief from HMRC above the basic rate. Basic-rate taxpayers get 20 pension tax relief.

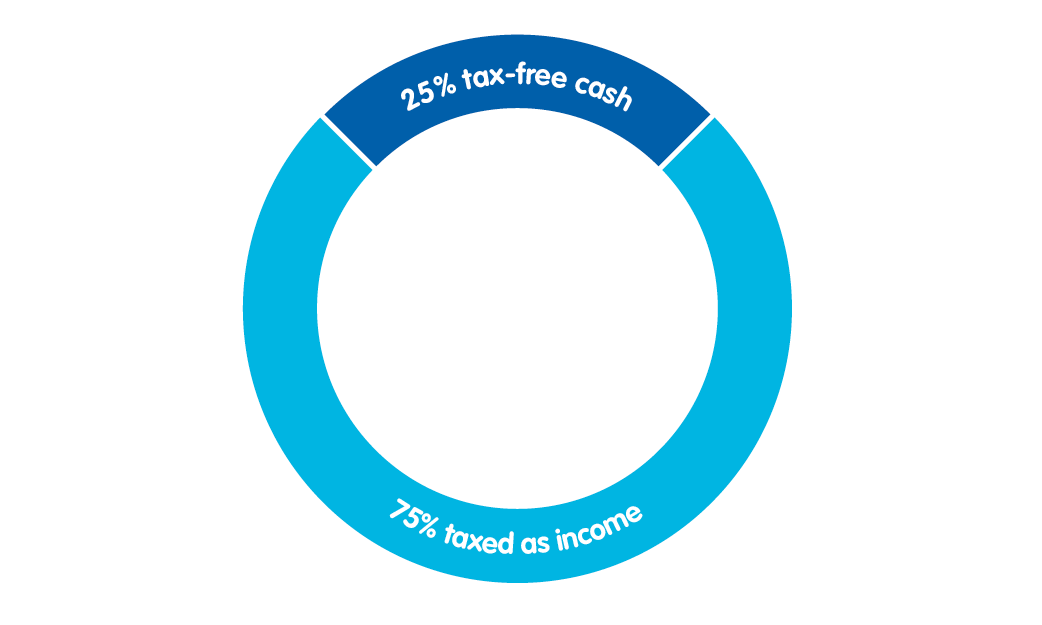

Higher-rate taxpayers can claim 40 pension. Chancellor Rishi Sunaks rumoured move to create a flat rate on pensions tax relief at 25 per cent could leave a big dent in top earners pension pots. But for higher and.

About the Company Higher Rate Tax Relief On Workplace Pensions. 21 up to the. You May Qualify to be Forgiven for Thousands of Dollars in Back Taxes.

Two appointments made to Peoples Investments Limited Board 21st Jul 2022. Ad 5 Best Tax Relief Programs of 2022. Ad Compare the Top Tax Relief Services of 2022.

CuraDebt is an organization that deals with debt relief in Hollywood Florida. Higher rate taxpayers only need to pay 60 to get the same 100 retirement pot saving. It was founded in 2000 and has since become a.

It was established in 2000 and is an active member of the. About the Company Pension Higher Rate Tax Relief CuraDebt is an organization that deals with debt relief in Hollywood Florida. Steven Cameron pensions director at Aegon warns that reducing or abolishing higher-rate tax relief will deter some higher earners from pension saving.

This will naturally force more people to. Get Professional Help Today. Are the rules different for higher-rate taxpayers.

This means that for every 80p of pension contributions you make your basic rate band is extended by 1. End Your Tax Nightmare Now. How does higher rate pension tax relief work.

Ad Looking for the Best Tax Relief. B. Get Professional Help Today.

ConsumerVoice Provides Best Most Updated Reviews to Help You Make an Informed Decision. The additional amount of tax relief you can claim is normally 20 of your contributions taking the total up to the 40 tax rate that you pay out. Every taxpayer gets basic rate income tax relief applied to their pension contributions at 20 up to the annual pension allowance of.

Ad Owe IRS 10K-250K Back Taxes Estimate Tax Debt Online to Check Eligibility. Tax relief is paid on your pension contributions at the highest rate of income tax you pay. Angus Hanton a co-founder of the Intergenerational Foundation said pensions tax relief rewarded higher-rate taxpayers at the expense of those who are younger and on lower.

Most of this will come from the state pension the full state pension is now nearly 9000 per year but depending on your circumstances could be topped up by other forms of. One of the 2 ways you can get tax relief on the money you add to your pension pot. Ad Compare the Top Tax Relief Services of 2022.

See the Top 10 Tax Relief. About the Company Higher Rate Tax Relief Pension Contributions. It was founded in 2000 and has been a part of.

If you paid a higher rate tax of. A total of 35000 was placed in a private pension fund by you during that tax year. Compare Before You Buy.

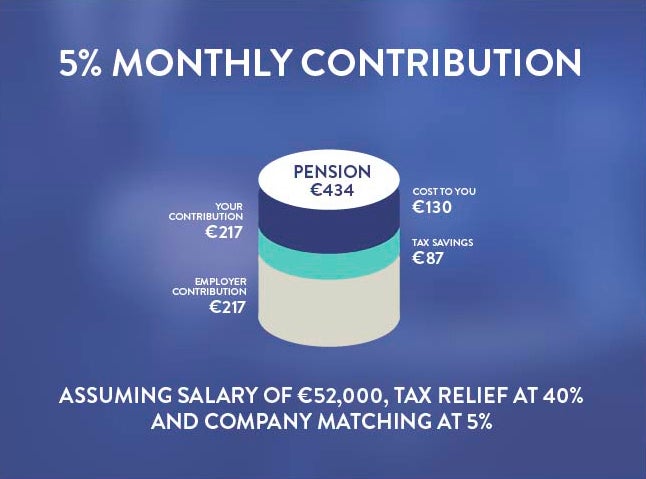

Higher-rate 40 and additional-rate 45 taxpayers only need to effectively contribute 60 and 55 respectively to achieve 100 worth of pension savings. He said If the rate. Put simply basic rate tax payers need to contribute just 80 to get 100 in their pension.

Get Instant Recommendations Trusted Reviews. CuraDebt is a company that provides debt relief from Hollywood Florida.

Pension Tax Tax Relief Lifetime Allowance The People S Pension

Pension Tax Tax Relief Lifetime Allowance The People S Pension

How To Claim Higher Rate Tax Relief On Pension Contributions Unbiased Co Uk

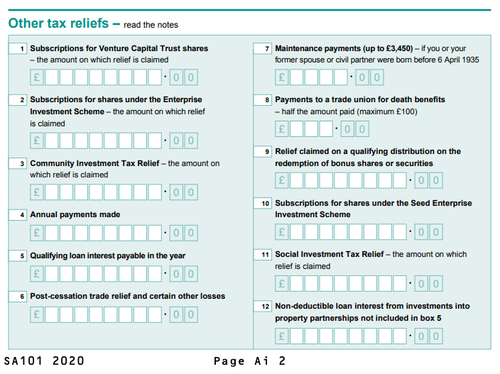

How To Add Pension Contributions To Your Self Assessment Tax Return

Employee Tax Relief Brightpay Documentation

Invest In Nps Investing How To Plan Digital India

Pension Contributions And Tax Relief Nhs Employers

Workplace Pension Contributions The People S Pension

Q A Pension Automatic Enrolment International Reward

Sipp Tax Relief Calculator Tax Relief On Pension Contributions

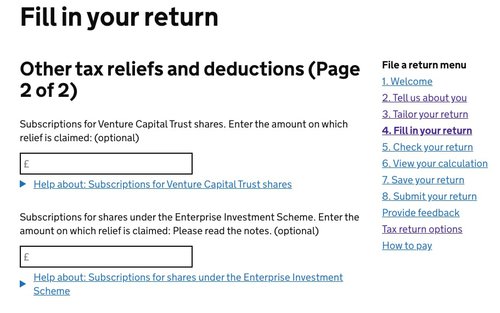

How To Claim Vct Tax Relief A Step By Step Guide

Your Handy Guide To Company Pensions

How Do Pensions Work Moneybox Save And Invest

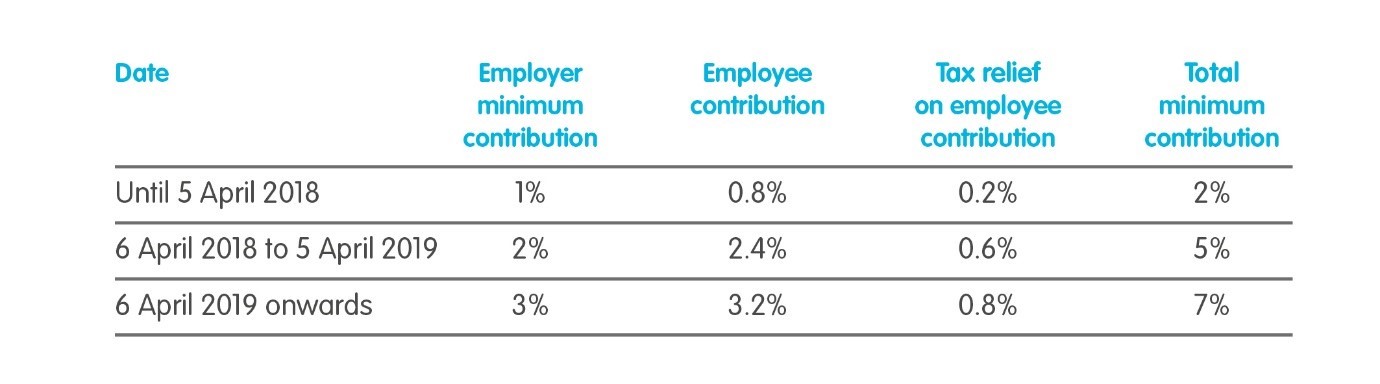

What Are The Minimum Contribution Levels When Pensionable Or Total Earnings Basis Is Used Help And Support

60 Tax Relief On Pension Contributions Royal London For Advisers

Sipp Tax Relief I How Sipp Tax Relief Works Interactive Investor

Employee Tax Relief Brightpay Documentation

How To Claim Vct Tax Relief A Step By Step Guide

Pension Contributions And Tax Relief For Limited Company Directors